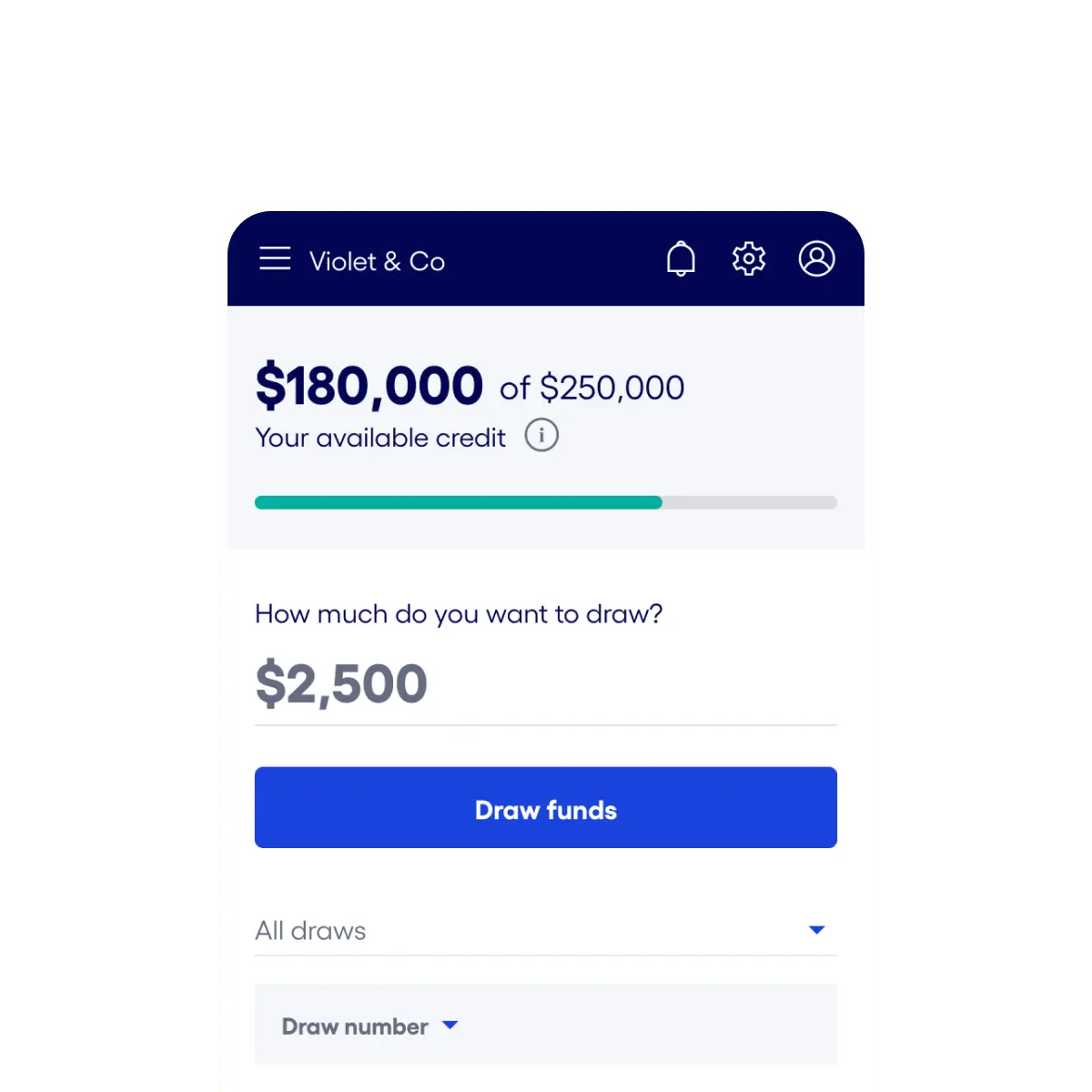

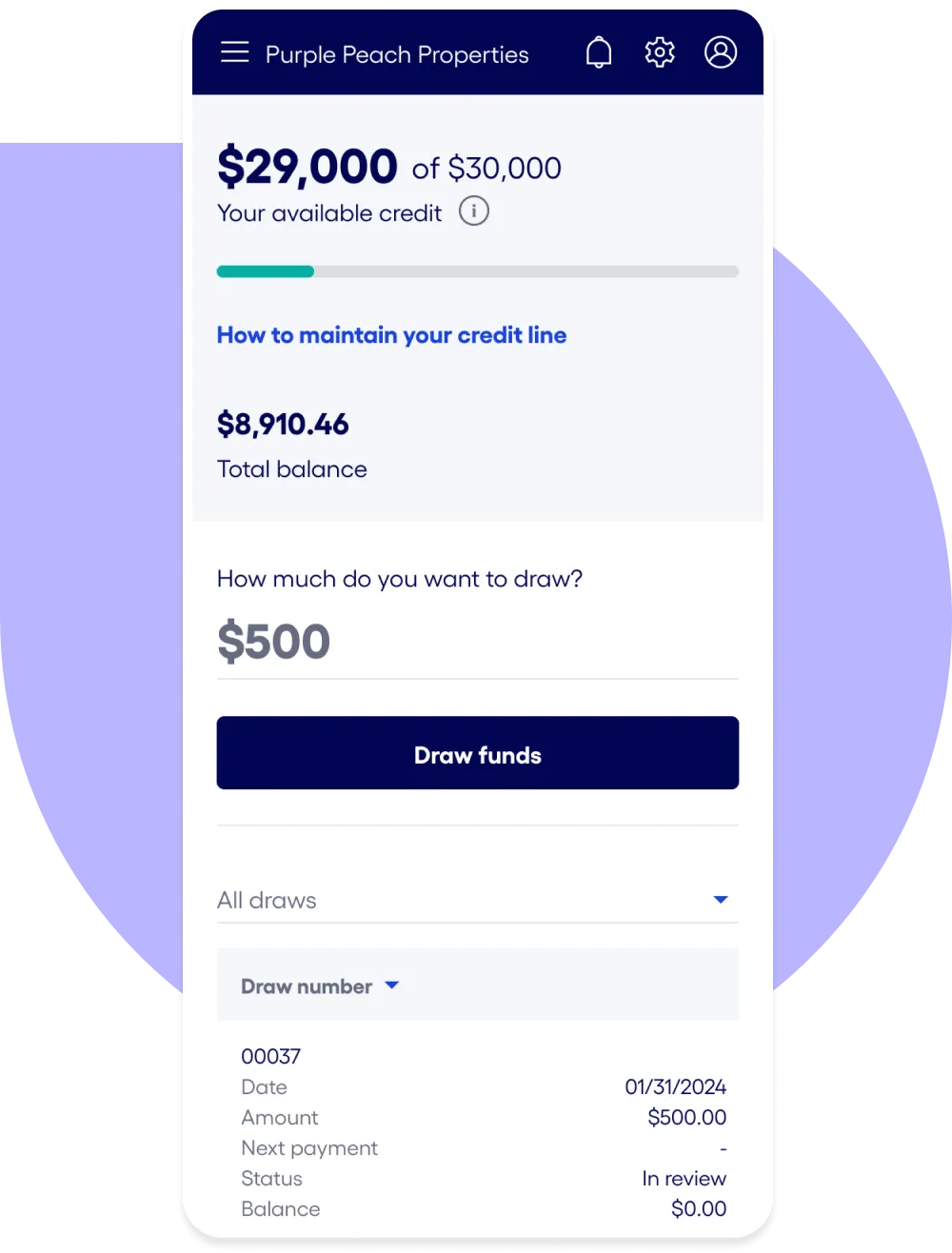

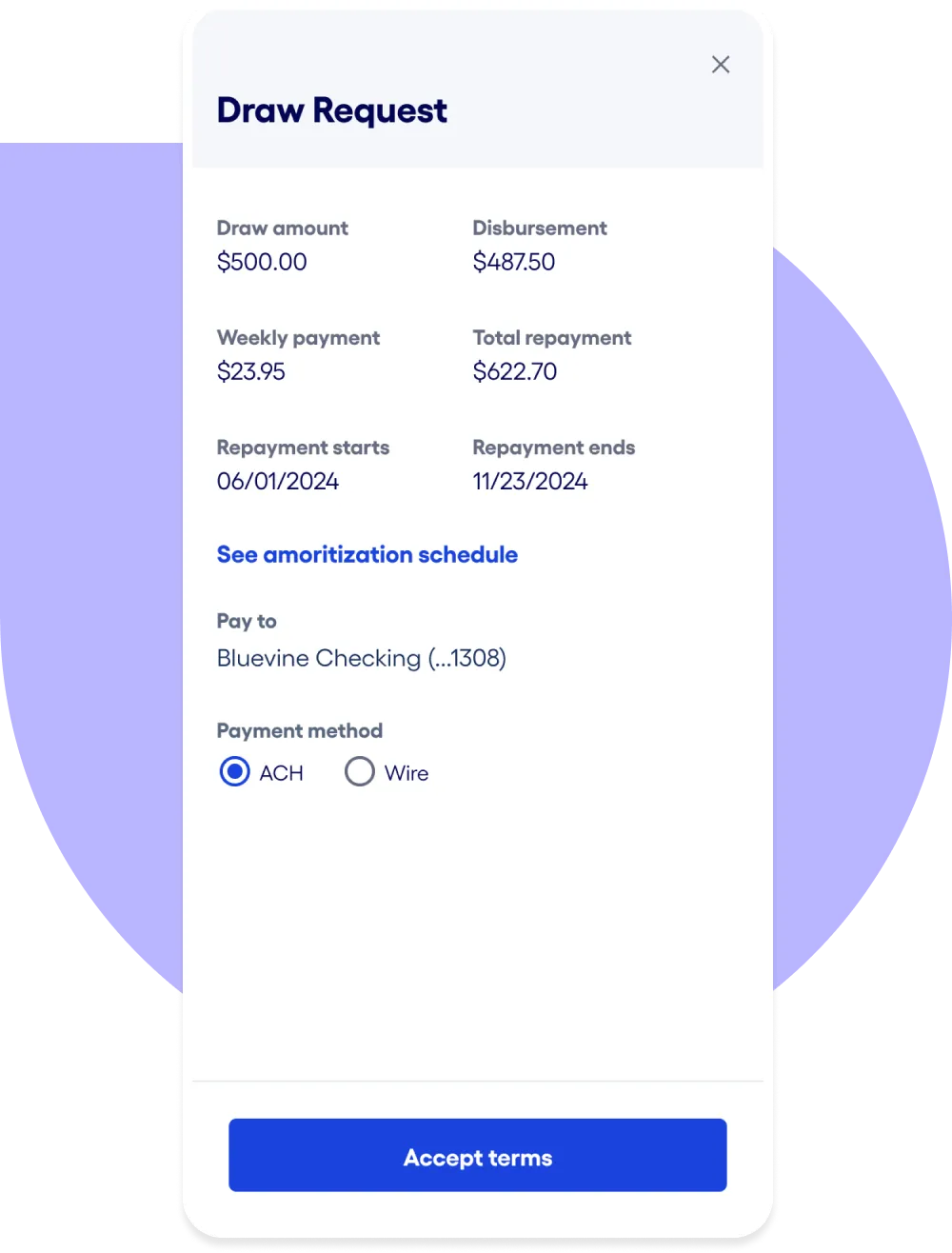

Fuel your growth

with a business

line of credit.

Access instant funding with rates starting at just 7.8% for top-qualified businesses. Apply risk-free with no impact to your credit score.

Start application